SEO is a hugely powerful channel for fintechs to support their customer acquisition. Financial decisions require research, and this will invariably involve a Google search at some stage.

This presents a wealth of opportunities to strategically foreground your brand at various points across your customer’s journey. However, the majority of fintechs don’t capitalise on this as much as they could.

Why? At the risk of oversimplifying, I believe the main reason is down to a lack of clarity around the different stages in the SEO funnel.

This leads to a fragmented approach to SEO, which results in occasional wins, but doesn’t effectively engage ideal customer profiles (ICPs) at different stages in their journey. This leads to mediocre results, and, ultimately, deprioritisation in favour of other channels.

Over the last few years, I’ve had the fortune to work with some of the world’s most exciting fintechs across a number of categories. In doing so, I’ve given a lot of thought to how we can map SEO efforts to different stages in the funnel, and therefore create a more cohesive approach that yields more customers and more revenue.

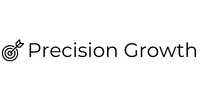

Presenting the fintech SEO funnel

This funnel represents the different audiences you should be targeting with SEO. It looks very similar to the traditional marketing funnel, but with some important nuances, which I’ll outline below.

The nomenclature is a work in progress – the important thing here is the distinction between different audiences and how to target them.

In a typical SEO campaign, we start from the bottom and work our way up. This is because the bottom of the funnel has more of a direct impact on revenue, which shows CFOs that SEO is worth the investment.

Let’s take a closer look at each stage of the funnel in more detail.

Branded Search

This audience has already decided they want your product and have chosen your brand. They are now navigating to your website to take action.

Some of this audience will type your URL into their browser, or head to the app store to download a mobile app. But many will type your brand name into Google, often combined with the specific product they’re looking for.

We are not connecting with any new audiences here, but rather ensuring people can access what they want as smoothly as possible.

This means we want to ensure:

- Each key product has its own page

- Page titles and meta descriptions are descriptive

- All our key pages are indexed by Google.

We’ll also want to check if competitors are bidding on your brand, and if so, make sure you’re also running ads.

These are the very basic foundations and are simple to implement. You’ve done all the hard work in demand generation, and SEO is the final touchpoint before converting.

Here are the common keyword patterns:

Brand Name

‘monzo’ ‘lemonade’ ‘yonder’ ‘xero’ ‘stripe’

Brand Name + Product

‘monzo savings account’, ‘lemonade pet insurance’ ‘yonder rewards card’, ‘stripe crypto payments’, ‘xero vat filing’

Demand Capture

This audience already knows they want your product type and may well have your brand in mind, but they are now doing some final research before they pull the trigger.

This is the highest ROI stage of the funnel to target. It’s also often the most competitive, as you’re competing with big affiliate and news sites in addition to your product competitors.

The common search patterns here are:

Product or category searches

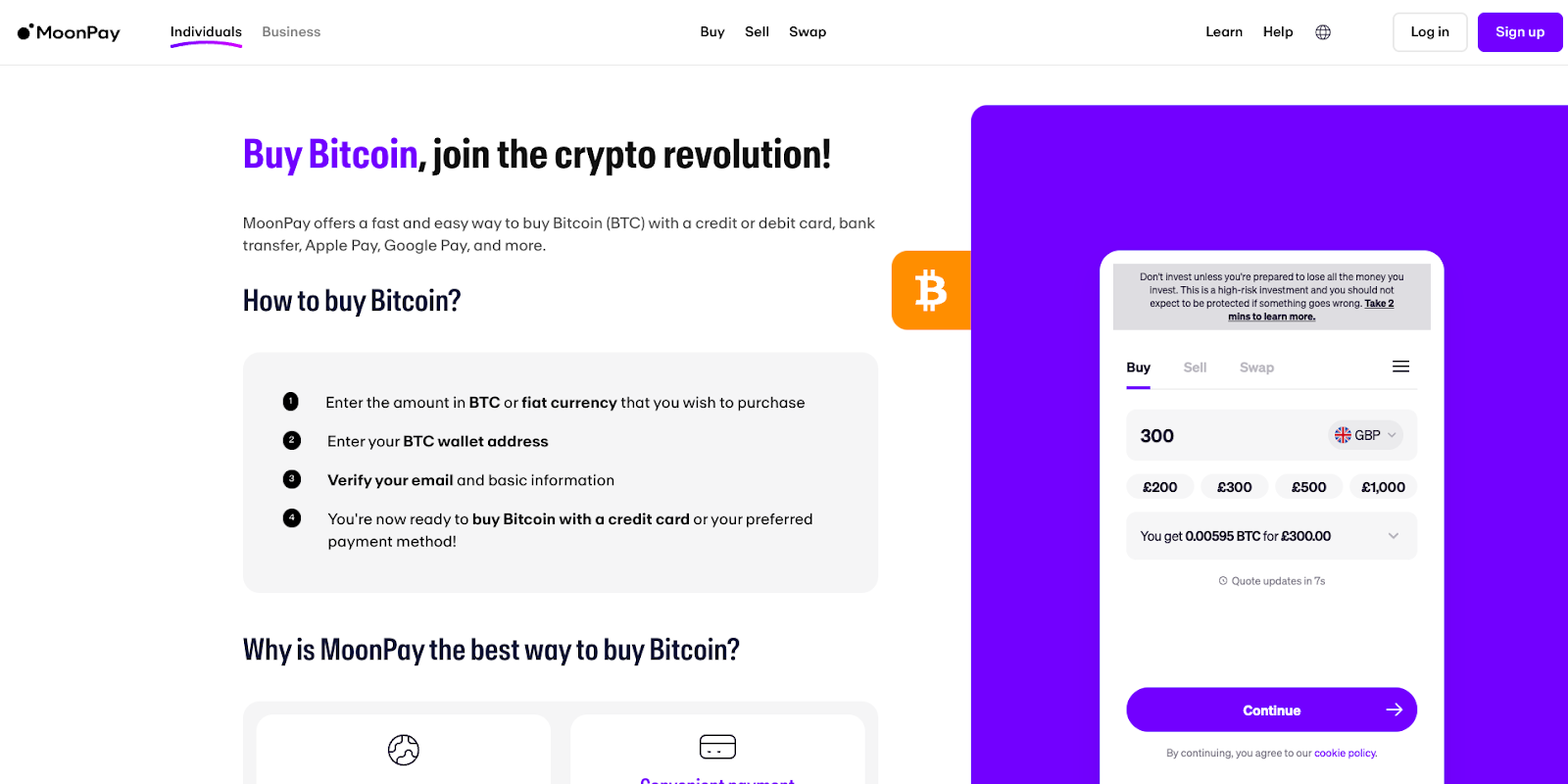

‘savings accounts’, ‘rewards cards’, ‘buy bitcoin’

Best {industry} {software, platform, app, companies}

‘best reverse mortgage companies’, ‘best business bank accounts’, ‘best business rewards card’ ‘best savings account rates’, ‘best platforms to stake eth’.

Competitor alternatives

‘stripe alternatives’, ‘blockfi alternatives’, ‘ramp alternatives’

It’s absolutely crucial that you’re in the conversation at this stage in the funnel. Otherwise, you risk doing all the hard work in demand generation, only to lose out to a competitor with a stronger presence here.

This rubs both ways – if you have a strong presence at this stage in the search funnel you can capitalise off the demand generation from other brands.

Usually you’ll cover these with a combination of blog posts and landing pages. These are not blog posts you’re going to be particularly proud of or share in your newsletter – they are pure revenue generators.

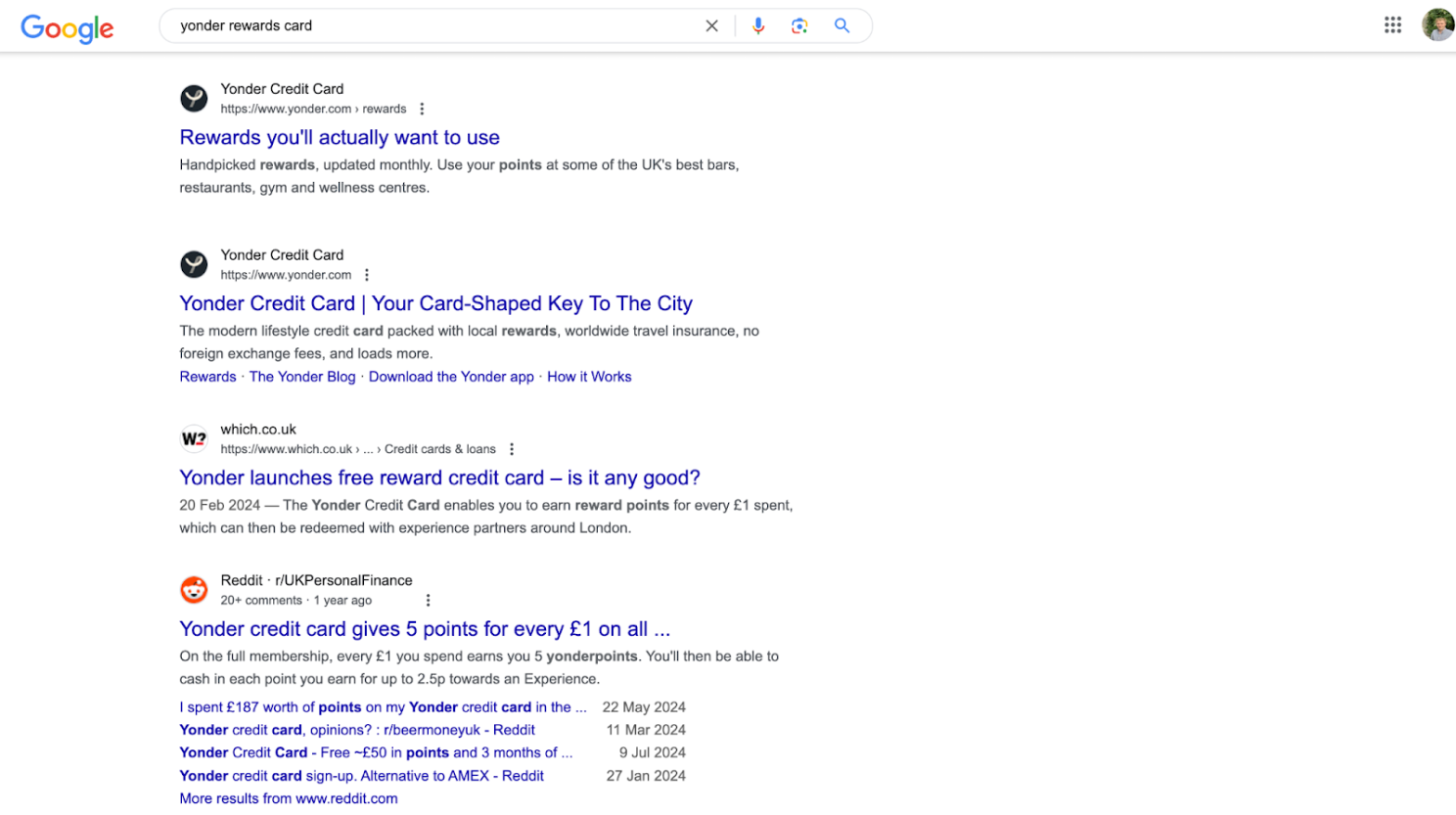

Here are some examples:

It’s worth noting here that you will likely see mega authority affiliate sites ranking at this stage in the funnel, especially for ‘Best X’ types of query.

Make sure you’re also featuring prominently on their listicles while also attacking with your own content. The idea is to position your product in as many of the top results as possible.

This increasingly includes having a Reddit strategy, as their visibility continues to skyrocket following the March 24 algorithm update.

Consideration

This audience is product aware and is now deciding if it’s the best move for them. They may be brand aware, but they want to decide if they want the product before choosing the brand.

The opportunity is to educate this audience before highlighting the advantages of your product over competitors.

You need to ask yourself: what kind of information and data are people looking for to finalise their decision? And how can you position your brand for these types of searches?

Here are some common patterns:

Pros and cons

‘benefits of rewards credit card’ ‘downsides of a reverse mortgage’ ‘should i get a business loan’

What is / guides

‘what is a home equity loan’, ‘eth staking guide’, ‘what is asset finance’, ‘what is apr’

Rate comparisons

‘business loan rates’, ‘reverse mortgage interest rates’, ‘compare rewards cards apr’

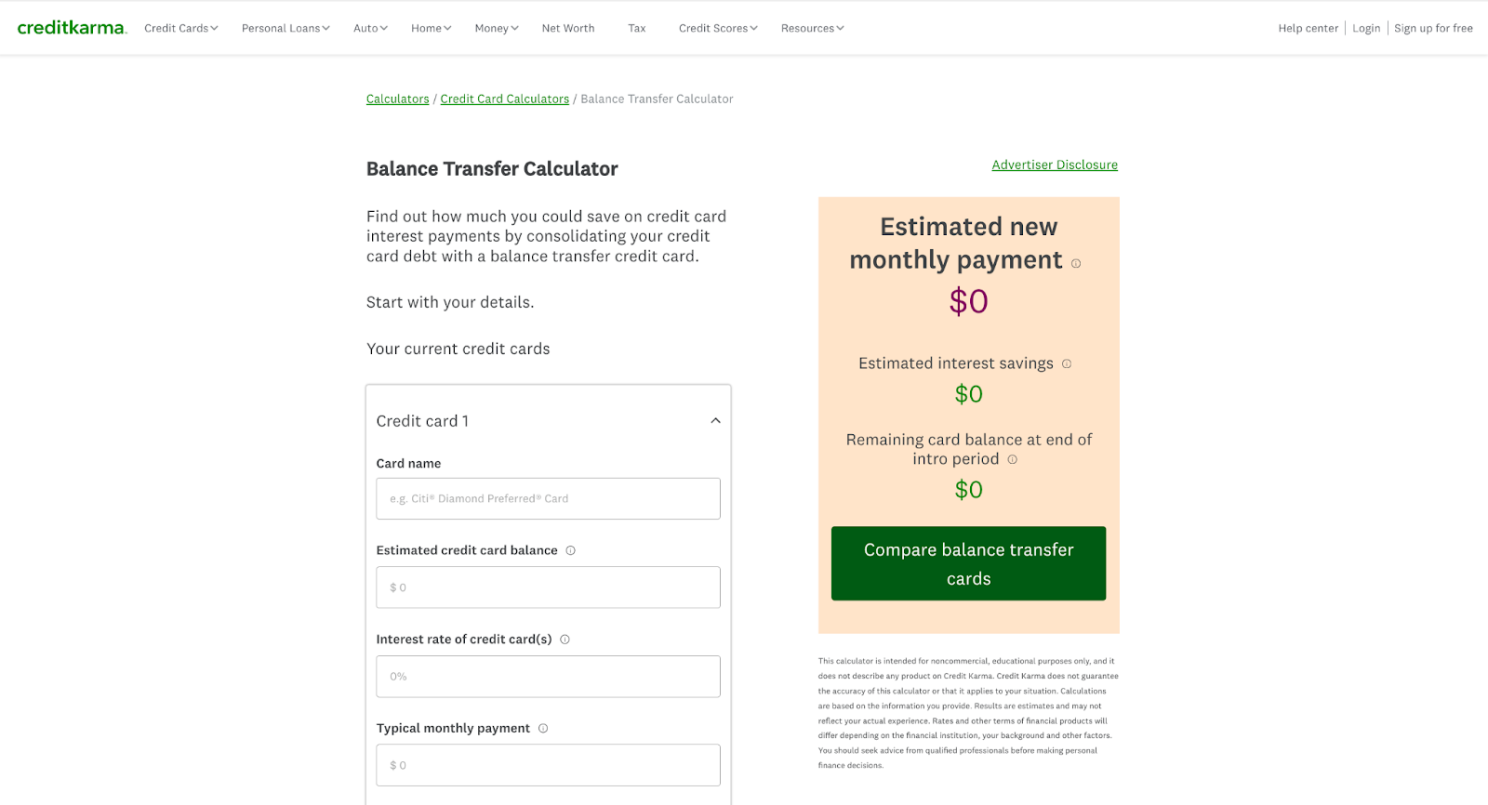

Financial calculators

‘mortgage calculator’, ‘asset finance calculator’, ‘staking calculator’

Most of this content will be blog posts, but financial calculators will require custom development. It’s worth noting here that financial calculators are a really powerful tool in fintech SEO which apply to a surprising amount of categories.

In this stage of the funnel, it’s also worth exploring tangential products where you might be able to redirect intent.

For example, if your platform offers reverse mortgages, you could target people searching for HELOC rates, then explain why reverse mortgages might be a more suitable option.

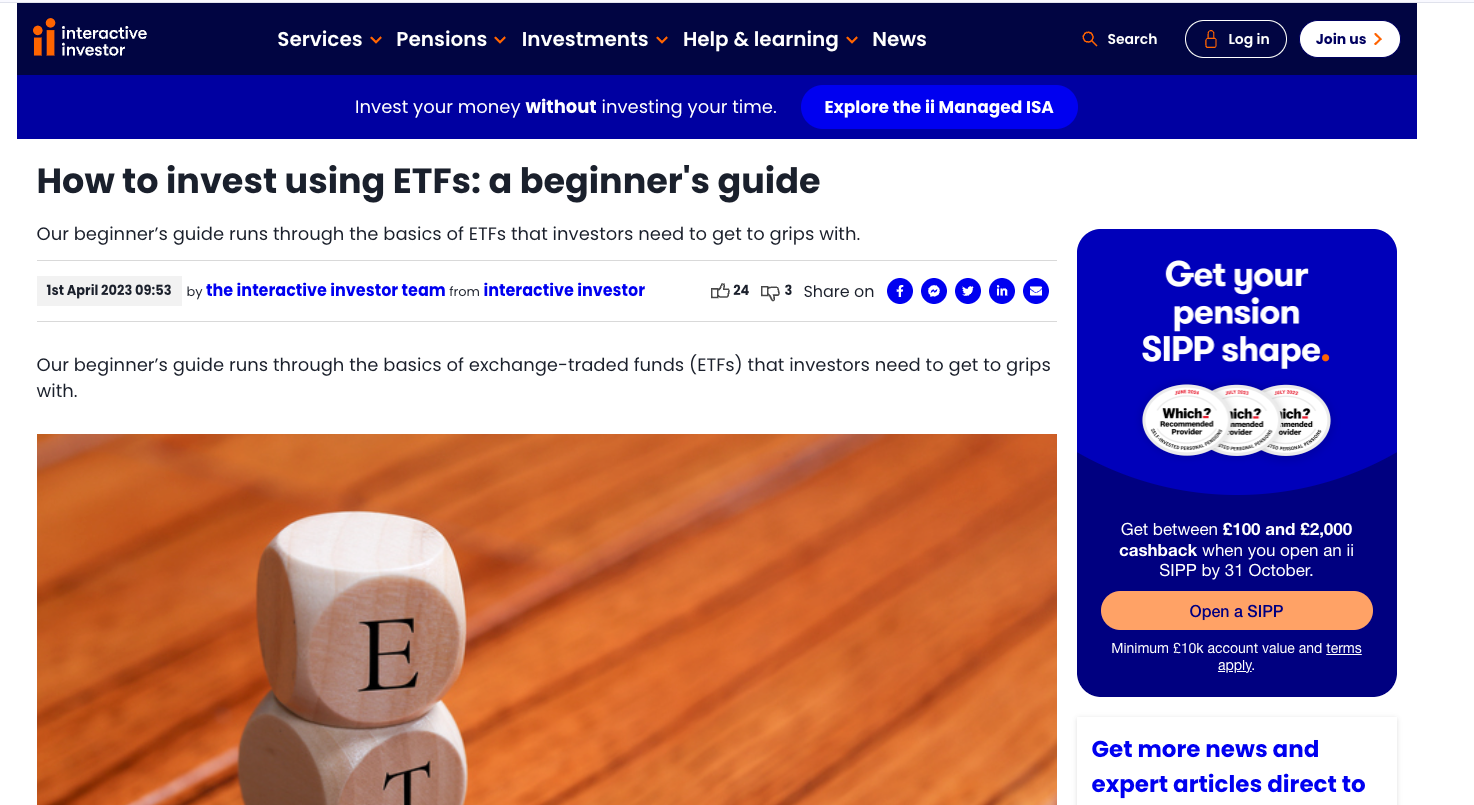

Or if your platform offers Ethereum savings accounts, you could target people searching for information on ETH staking, then explain why your savings account might make more sense.

Jobs To Be Done / Pain Points

This audience has a pain point they need to solve, or a job they need to do. Crucially though, they’re not sure how to do it yet.

In other words, this audience is problem aware, but not solution aware.

The opportunity here is to educate your audience on how to do their job or solve their problem, and then demonstrate how your product can help with this.

Here are the common keyword patterns:

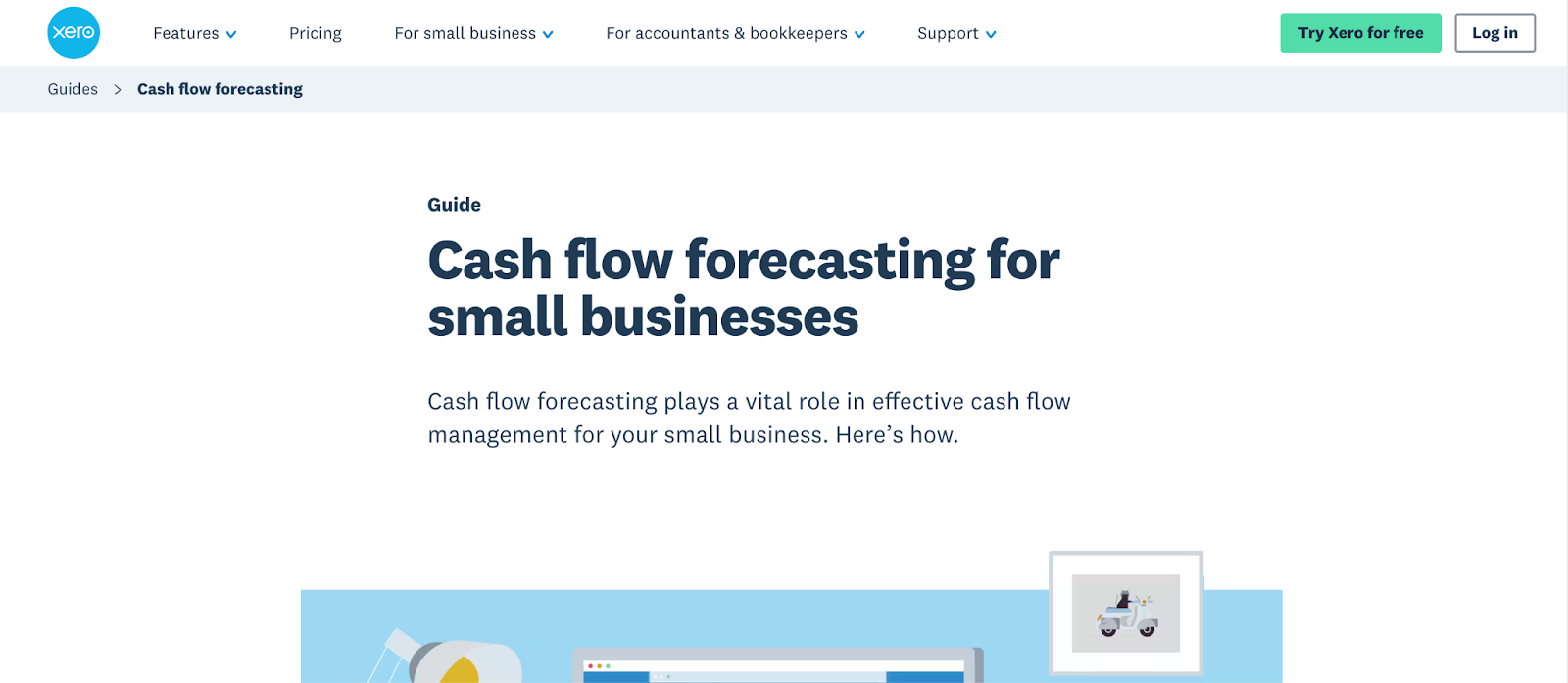

How to

‘how to file a vat return’, ‘how to borrow against bitcoin’, ‘how to pay off credit card debt’, ‘how to get a business loan’, ‘how to forecast cash flow’

Way(s) to

‘best way to buy bitcoin safely’, ‘best way to consolidate debt’, ‘best way to invest in etfs’

The type of content you create to address these topics will mostly be blog content.

For this audience, you’ll want to create a map of the jobs and pain points of your ICPs. Then, base your keyword research around these.

I love targeting this audience as it requires a bit more creativity. You can also get super high conversion rates if you position your product well.

In terms of how much to talk about your product in this type of content, the 80-20 rule is a good benchmark (i.e. 80% talking in general terms, 20% demonstrating how your product helps).

Awareness and Credibility Building

This audience has not shown any direct intent for your product, but are searching for topics in your broader industry which suggest they might be interested in your product at some point.

This audience is often overlooked as it’s harder to tie to revenue in attribution models. But in the world of fintech, where trust is a precious commodity, it can be a really good way to build meaningful touch points at scale with a relevant audience.

Generally speaking, you primarily target this audience with blog content, but there might also be a programmatic SEO opportunity (i.e. using a database and a template to generate thousands of data pages which match popular searches).

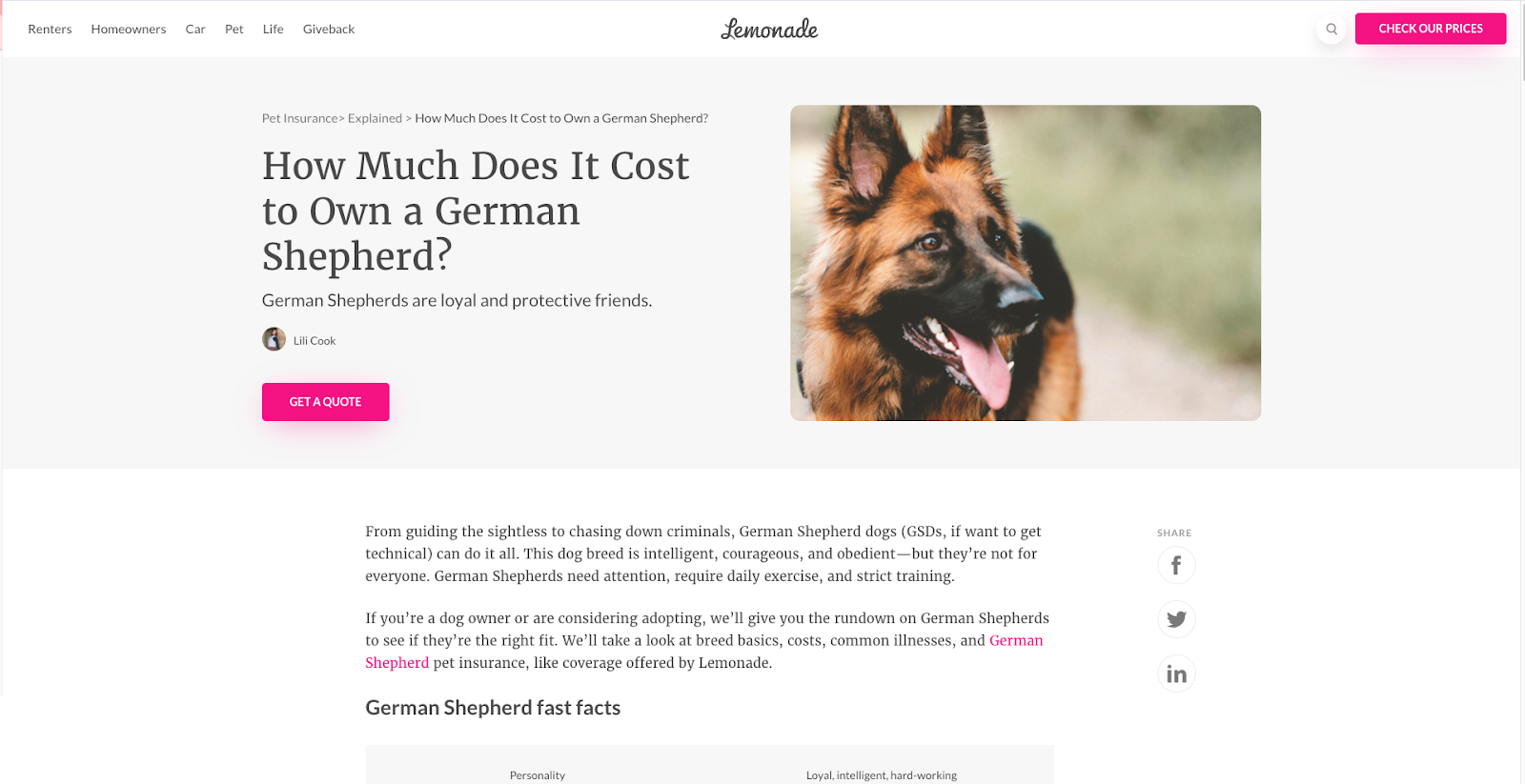

Lemonade (a digital insurance platform) targets people searching for the price of different dog breeds, with the logic being this audience might need pet insurance down the line.

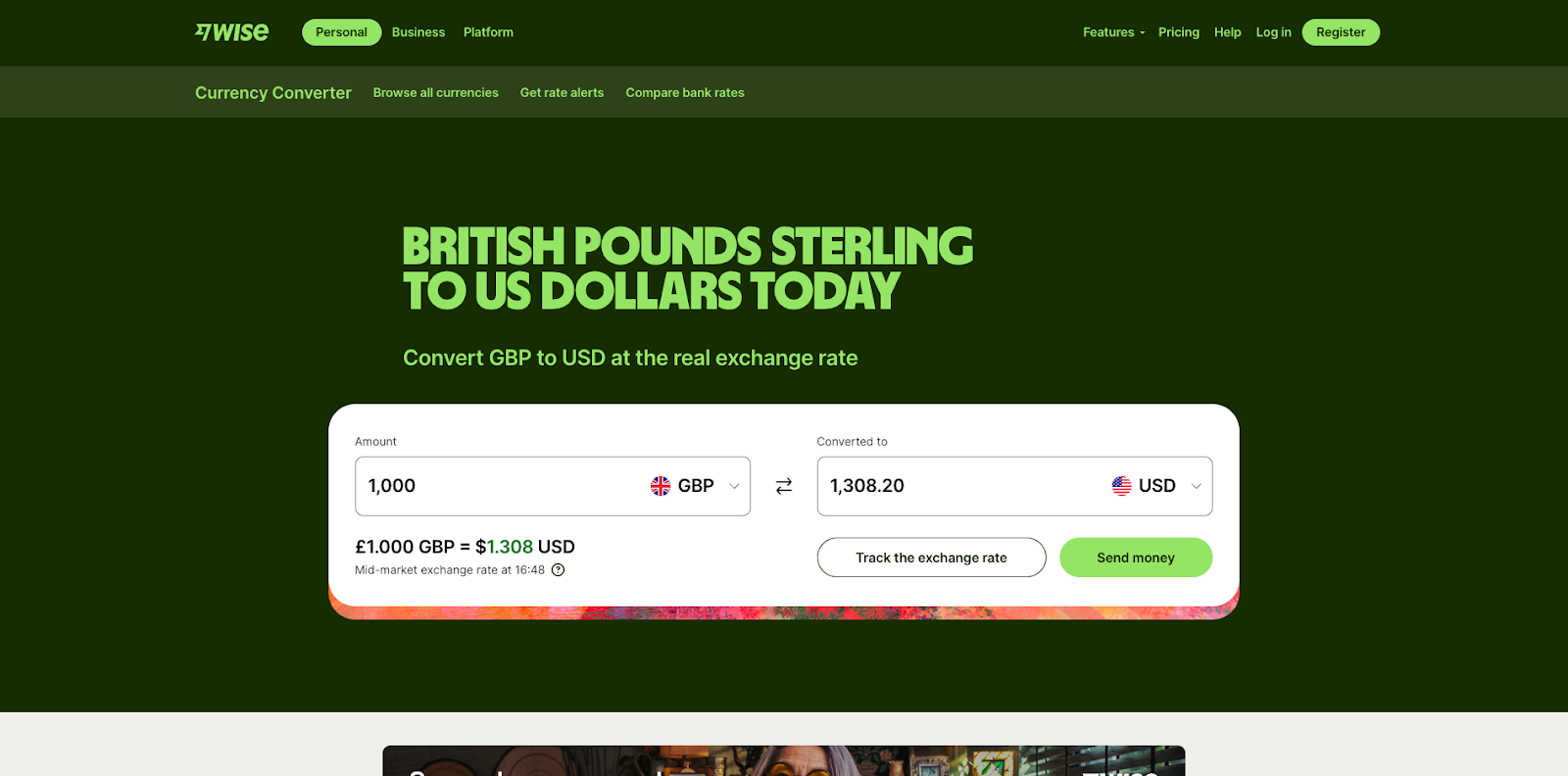

Meanwhile, Wise targets the millions of people searching every day for the conversion rate between different currency pairs, with the view that some of this audience might want to send money abroad using their low fee product.

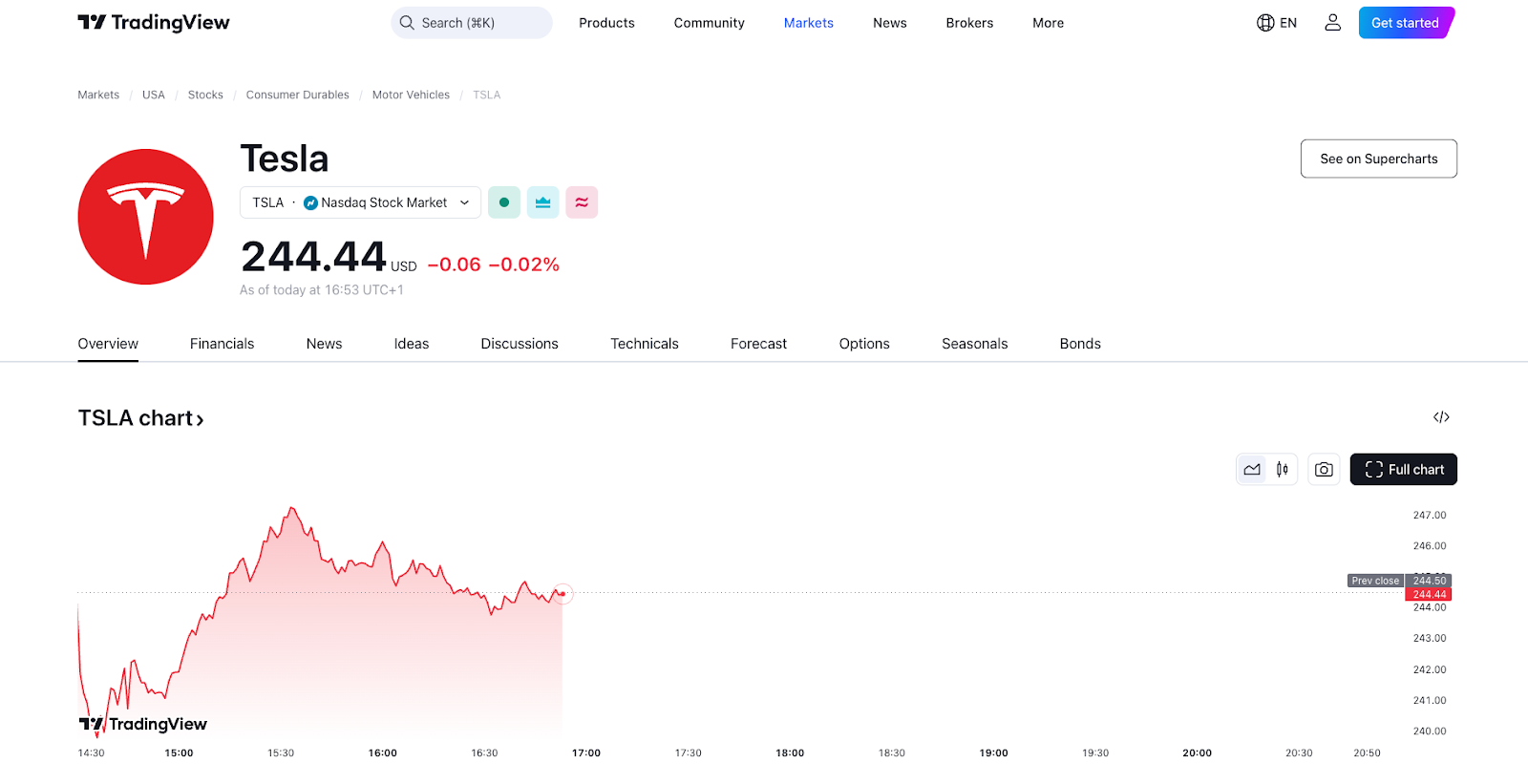

And TradingView generates millions of monthly visitors from people searching different stock prices with their programmatically generated pages, positioning them in front of a broad audience who are likely to be interested in investing.

Closing thoughts

SEO can be a confusing channel, but it’s insanely powerful when wielded correctly. I hope this funnel gives you a tool to approach SEO in a more structured way and thereby increase your yields.

By the way, I’m going to be sharing insider fintech SEO advice in my new LinkedIn newsletter Fintech SEO Growth. It will be a mixture of higher level strategy and quick win tactics to juice traffic and revenue. If you want an edge against competitors in your customer acquisition, subscribe here. Don’t miss out!